Economic Violence

Control Through Currency: Understanding Economic Violence

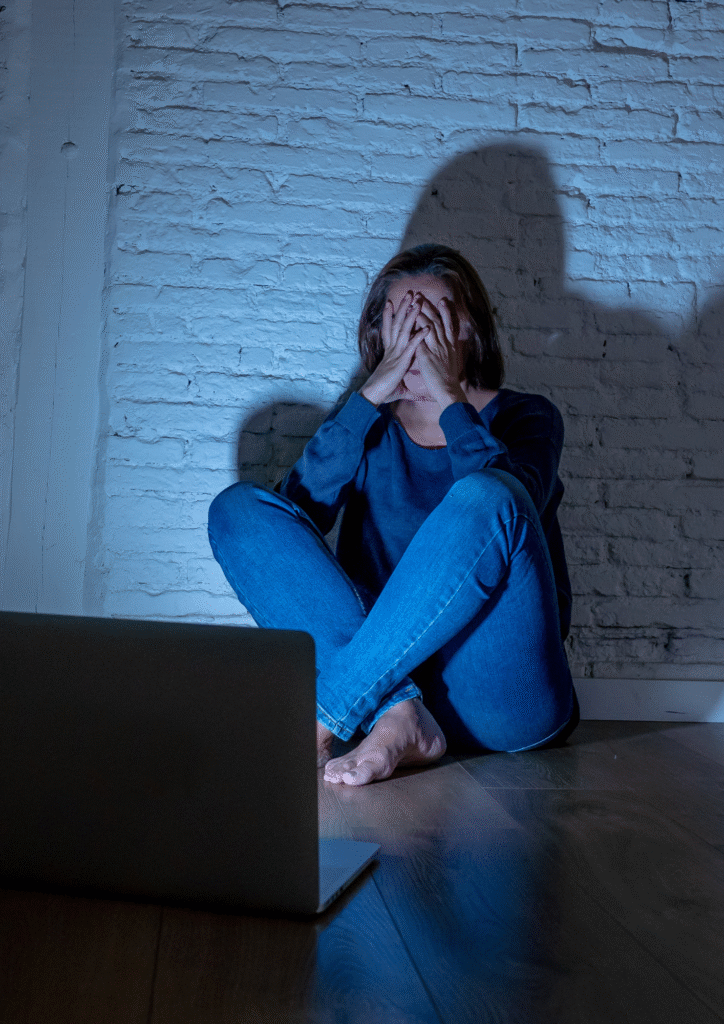

When we talk about violence, we often picture physical assaults or hear about emotional manipulation. However, there’s a deeply insidious form of abuse that often goes unrecognized: economic violence. It’s a subtle yet incredibly powerful tactic designed to limit a person’s financial freedom and independence, effectively trapping them in an abusive relationship. This form of violence is not about a lack of money; it’s about the strategic control and manipulation of financial resources to maintain power over another individual.

Economic violence can be devastating because it directly impacts a survivor’s ability to leave an abusive situation, seek safety, or rebuild their life. Without financial independence, the pathway to freedom is severely obstructed.

The Tactics of Financial Control and Coercion

Economic violence manifests in numerous ways, often escalating over time. Here are some common tactics perpetrators use:

- Controlling Access to Money: This is perhaps the most common form. An abuser might:

- Withhold money or an allowance, even for basic necessities like food or medicine.

- Demand that all income be handed over to them.

- Monitor or control all spending, requiring receipts for every purchase.

- Give an “allowance” that is insufficient or forces the victim to beg for money.

- Refuse to allow the victim to have their own bank account or credit cards.

- Force the victim to ask for money for every single expense.

- Preventing Employment or Education: Abusers actively undermine a person’s ability to earn their own income or gain skills, such as:

- Forbidding them from working or attending school/training.

- Sabotaging job interviews (e.g., calling the employer, creating a scene).

- Harassing them at their workplace, leading to termination.

- Making it impossible to manage work/education commitments by creating chaos at home or with childcare.

- Destroying educational materials or work tools.

- Sabotaging Career Opportunities: Even if the victim is employed, the abuser might:

- Constantly call or text them at work, causing distractions or problems with supervisors.

- Insist the victim quits a job they enjoy.

- Undermine their confidence so they don’t apply for promotions or better jobs.

- Accumulating Debt in Someone’s Name (Financial Fraud/Exploitation): This is a particularly damaging tactic where the abuser:

- Forces the victim to take out loans or credit cards in their name.

- Uses the victim’s identity to open accounts, often without their knowledge.

- Runs up debt on joint accounts or individual accounts, leaving the victim responsible.

- Refuses to pay bills, leading to utility shut-offs or eviction notices.

- Steals money or assets from the victim.

- Withholding Financial Support: Even if the abuser is the primary earner, they might:

- Refuse to contribute to household expenses, leaving the burden solely on the victim.

- Threaten to cut off financial support if the victim doesn’t comply with their demands.

- Deny child support or other legally mandated payments.

- Controlling Shared Assets:

- Refusing to allow access to joint bank accounts or jointly owned property.

- Selling or destroying assets without consent.

The Trap: How Economic Abuse Makes Leaving Difficult

Economic abuse is a powerful tool for maintaining control because it creates a financial dependency that severely limits a survivor’s options. When a person has no access to funds, no independent income, and potentially significant debt:

- They cannot afford to leave: Rent, food, transportation, and legal fees become insurmountable barriers.

- Safety is compromised: Without money, finding a safe place to stay (like a shelter or a new apartment) is nearly impossible.

- Children are at risk: Fear of not being able to provide for children often keeps survivors in abusive relationships.

- Lack of resources for legal help: Accessing lawyers for divorce, custody, or protection orders often requires funds.

- Sense of hopelessness: The constant struggle and financial deprivation erode self-esteem and lead to a feeling that escape is impossible.

Identifying Economic Abuse and Steps Toward Financial Independence

Recognizing economic abuse is the first, crucial step. If you experience any of the tactics listed above, or feel a profound lack of financial control in your relationship, you may be experiencing economic violence.

Here are strategies for identifying economic abuse and steps toward financial independence and recovery:

- Acknowledge and Validate Your Experience: Understand that this is a form of abuse, and it is not your fault.

- Start Documenting:

- Keep a record of all financial transactions, even small ones.

- Note instances where money was withheld, denied, or misused.

- Gather any financial documents you can safely access (bank statements, pay stubs, loan agreements).

- Take screenshots of any abusive messages related to money.

- Build a Secret “Escape Fund” (if safe):

- If possible, squirrel away small amounts of money in a separate, secret bank account that the abuser cannot access.

- Consider opening an account at a different bank from any shared accounts.

- Even small amounts can make a difference in an emergency.

- Seek Financial Counseling (Confidential):

- Organizations that support survivors of violence often have financial counselors or can refer you to them. They can help you understand your options, deal with debt, and create a budget for independence.

- Understand Your Legal Rights:

- In Suriname, legal aid services or organizations like the Women’s Rights Centre can advise you on your rights regarding shared property, marital assets, child support, and protection against financial fraud.

- It’s important to know the laws regarding shared marital property and spousal support, as these can be crucial in divorce proceedings.

- Secure Important Documents:

- Keep copies of your ID, passport, birth certificate, children’s birth certificates, social security cards, marriage certificates, and any financial documents in a safe, secret location, or with a trusted friend/family member.

- Reconnect with Your Support Network:

- Reach out to trusted friends, family, or community members. They might offer temporary housing, emotional support, or even small financial assistance that can be critical.

- Explore Employment and Education Options (Safely):

- If you’re not working, discreetly explore job opportunities or training programs.

- Consider jobs that offer flexibility or are less likely to attract the abuser’s attention initially.

- Report Financial Fraud:

- If the abuser has opened accounts or incurred debt in your name without your consent, report this to the police and financial institutions.

Economic violence is a complex and often hidden aspect of abuse, but understanding it is key to breaking free. By acknowledging its presence, documenting its impact, and strategically planning for financial independence, survivors can begin to reclaim their power and build a future free from control and coercion. Your financial independence is your pathway to freedom and safety.

Would you like to elaborate on specific aspects of economic abuse or discuss recovery strategies in more detail?

Responses